Investment Philosophy

We bring an Institutional investment approach to individual investors. We focus on risk, low expenses, and diversifying holdings in a smarter way. We are conservative without being conventional.

Investment Strategy

MANAGE RISK: The institutional approach to investing starts with understanding how much risk, if any, is required to meet the institution’s obligations. For the individual investor, this translates into understanding your expense needs, both long and short-term. Your cash flow needs form the core foundation of our investment strategy for you. Why? It’s important for you to know, that regardless of whether the market is up 20%, or down 20%, your income is protected.

MANAGE RISK: The institutional approach to investing starts with understanding how much risk, if any, is required to meet the institution’s obligations. For the individual investor, this translates into understanding your expense needs, both long and short-term. Your cash flow needs form the core foundation of our investment strategy for you. Why? It’s important for you to know, that regardless of whether the market is up 20%, or down 20%, your income is protected.

LOWER EXPENSES: Another staple of institutional investors is that they have access to lower cost investments. We bring that advantage to our clients by utilizing ETF’s (exchange traded funds), open-end passive mutual funds, and SMA’s (separately managed accounts) for the core of each portfolio. And because we are fiduciary advisors, all fees are transparent. You will be able to see exactly what your costs are.

SMART DIVERSIFICATION: The 2008 crash highlighted the need for a more sophisticated diversification of risk. We are conservative without being conventional. We use a combination of low cost, passive index funds, index tracking ETF’s, as well as active managers to fill the more specialized elements of the portfolio that we expect to provide much needed diversification benefits.

The Nature of Emotions in Financial Decision-Making

There are a lot of investment gurus, TV personalities, books and websites that want you to believe that investing is easy and you can do it yourself if you just read their book, buy their videos, or subscribe to their website. The fact is, investing IS simple, but it is NOT easy. What makes it so hard is managing your emotions when the market is dropping 10, 15, 20% or more.

The ups and downs of the market, however, present opportunities for disciplined investors to buy low and sell high. Our ability to take advantage of these opportunities lies in how well we understand how you will react to this volatility. As disciplined as our process is, we still have to account for this human element and the potential to make less rational decisions rooted in fear, panic, or greed. We combine the science of cognitive psychology with behavioral finance principles to evaluate the level of volatility you are comfortable with. For example, we review past losses of each portfolio during previous market corrections so you get a better sense of how your investment portfolio might react during the next correction or bear market. While past performance is no indication of future results, it serves as a meaningful point of discussion to understand the potential losses in dollar terms without the stress of it being an actual loss in the present. Another example of how we merge science and practice to help manage emotions, is to calculate the impact that each level of loss has on the actual funding of your life goals. Successful investing, in our opinion, is not about beating the S&P 500. Successful investing is about reaching your life goals. This is another example of Financial Life Management in action.

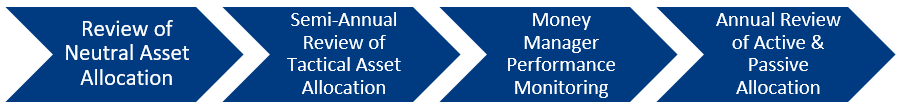

Investment Process

A lot of investment firms extol their proprietary formulas, special processes or sheer size. We’ve never seen any firm or their process significantly outperform the market over any extended period of time. We don’t have a secret process. We just focus on fundamental research, analysis, and you.

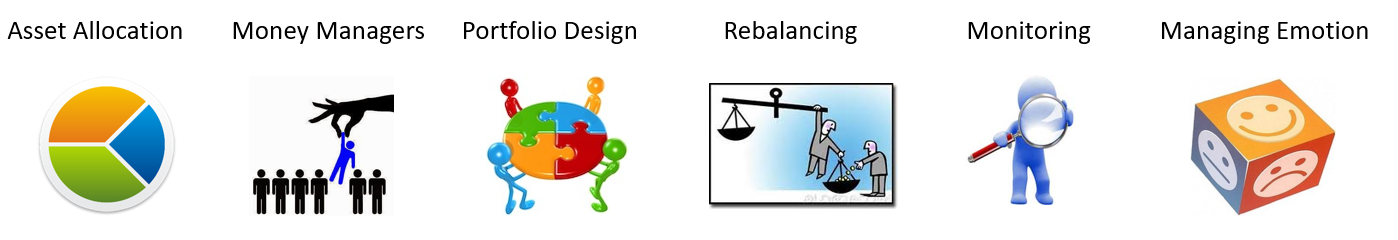

Asset Class Allocation

Asset Allocation - Studies beginning with Bengen (1994), as well as our experience, indicate that asset allocation is responsible for the majority of a portfolio’s return over time. So that’s where we start our investment process. We base our asset allocation on a number of factors including the amount of risk you want and the return you need for your plan to be successful.

Selecting Money Managers

To provide industry and market expertise in our chosen asset classes and markets, we’ve assembled a number of specialized passive and active money managers. We follow a deliberate process to select and monitor these managers.

Portfolio Design

We create model portfolios to meet our clients’ investment goals. At one end, we have more conservative portfolios with a goal of generating income while preserving principal. At the other end are portfolios designed for a higher level of volatility and growth.

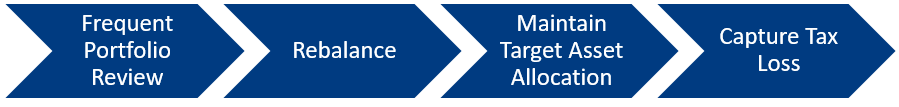

Rebalancing

We rebalance portfolios according to market shifts, a process we believe is superior to rebalancing once a year. We may rebalance to help keep your portfolio in line with your target asset allocations, capture potential tax losses, and create opportunities to increase returns by taking advantage of over reactions in the markets.

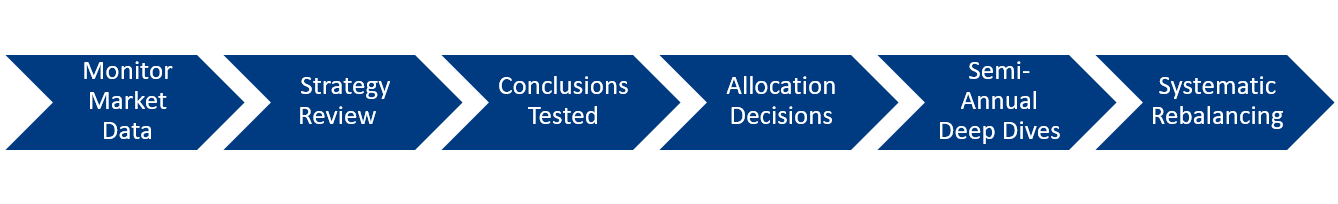

Monitoring

We regularly monitor both the asset allocation of our investment portfolios and the performance of our managers, adjusting both as necessary.

Managing Emotion

There are a lot of investment gurus, TV personalities, books and websites that want you to believe that investing is easy and you can do it yourself if you just read their book, buy their video, or subscribe to their website. The fact is, investing IS simple, but it is NOT easy. What makes it so hard is managing your emotions when the market is dropping 10, 15, 20% or more.

The ups and downs of the market, however, present opportunities for disciplined investors to buy low and sell high, especially with a disciplined rebalancing strategy. Our ability to take advantage of these opportunities lies in how well we understand how you will react to DOWNSIDE volatility. As disciplined as our process is, we still have to account for this human element and the potential to make less rational decisions rooted in fear, panic, or greed. We combine the science of cognitive psychology with behavioral finance principles to evaluate the level of volatility you are comfortable with. For example, we review past losses of each portfolio during previous market corrections so you get a better sense of how your investment portfolio might react during the next correction or bear market. While past performance is no indication of future results, it serves as a meaningful point of discussion to understand the potential losses in dollar terms, without the stress of it being an actual loss in the present. Another example of how we merge science and practice to help manage emotions, is to calculate the impact that each level of loss has on the actual funding of your life goals. Successful investing, in our opinion, is not about beating the S&P 500. Successful investing is about reaching your life goals. This is another example of Financial Life Management in action.